Is it Worth Going Back to School to Study: An Analysis & Equation

Thinking about going back to school to improve your long-term financial situation? There are many issues to consider when determining whether or not going back to school makes financial sense. And this is exactly what I have analyzed and I hope those debating can find the answer they are looking for.

For most, it’s a calculation of the costs of going back to school versus some perceived financial gain associated with further education. So obviously there is a trade off, let’s delve deeper into these issues so you can make an informed decision. If you’re lucky enough to have family or a sponsor willing to burden the majority of the costs then this equation won’t specifically apply to you.

The key first point is to identify the major financial issues involved in your decision to go back to school. Let’s go over that first.

Cost

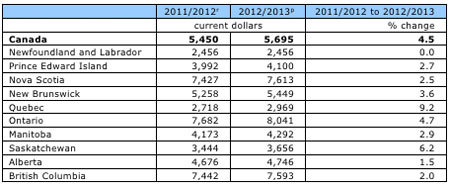

The most obvious cost is tuition and it can be significant. For starters, tuition is not uniform throughout the country and with some minimal research you can compare tuition costs across different universities—obviously for this analysis the ‘quality’ of the education cannot be factored. Below is a comparison of the average tuition costs across the ten provinces for both undergraduate and graduate studies:

Source: http://www.statcan.gc.ca/daily-quotidien/120912/t120912a002-eng.htm

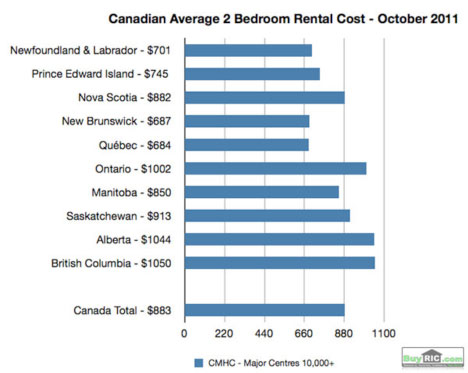

Also, you may find that not only is the tuition cheaper in other cities but the overall cost of living may also be lower. Reduced expenses for rent, eating out, etc. may offset potential loss of income. Of course the opposite can be true as well; the cost of living may increase adding onto your financial outflow. Below is a comparison of the average rent across Canadian provinces for a 2 bedroom apartment:

If you are going to go into debt to pay for your schooling, then you also have to factor that into the equation. A recent report commissioned by the Community Foundations of Canada found that graduating students carry debt loads that average between $20,000 and $30,000 and take an average of 14 years to pay off.

What to Study & Where to study

It’s common knowledge that different programs have different levels of desirability in terms of employment and promotion prospects. You don’t want to find yourself in a situation where pursuing a degree will have minimal impact on improving your financial prospects.

A survey published in the Wall Street journal used 2010 census data to compare the unemployment and earning potential of 173 different degrees. It’s interesting to note that many science, math and engineering majors had high employment percentages, while majors in the liberal arts had low percentages, according to the survey.

Here are the 20 highest and lowest unemployment rates by degree;

20 HIGHEST UNEMPLOYMENT RATES BY DEGREE:

- 1. CLINICAL PSYCHOLOGY – 19.5%

- 2. MISCELLANEOUS FINE ARTS – 16.2%

- 3. UNITED STATES HISTORY – 15.1%

- 4. LIBRARY SCIENCE – 15.0%

- 5. EDUCATIONAL PSYCHOLOGY & MILITARY TECHNOLOGIES, TIE – 10.9%

- 6. ARCHITECTURE – 10.6%

- 7. INDUSTRIAL AND ORGANIZATIONAL PSYCHOLOGY – 10.4%

- 8. MISCELLANEOUS PSYCHOLOGY – 10.3%

- 9. LINGUISTICS AND COMPARATIVE LANGUAGE AND LITERATURE – 10.2%

- 10. COMPUTER ADMINISTRATION MANAGEMENT AND SECURITY – 9.5%

- 11. VISUAL AND PERFORMING ARTS & ENGINEERING AND INDUSTRIAL MANAGEMENT, TIE – 9.2%

- 12. SOCIAL PSYCHOLOGY – 8.8%

- 13. INTERNATIONAL BUSINESS – 8.5%

- 14. HUMANITIES & ELECTRICAL AND MECHANIC REPAIRS AND TECHNOLOGIES, TIE – 8.4%

- 15. GENERAL SOCIAL SCIENCES – 8.2%

- 16. COMMERCIAL ART AND GRAPHIC DESIGN – 8.1%

- 17. STUDIO ARTS – 8.0%

- 18. PRE-LAW AND LEGAL STUDIES – 7.9%

- 19. MATERIALS ENGINEERING AND MATERIALS SCIENCE & COMPOSITION AND SPEECH, TIE – 7.7%

- 20. LIBERAL ARTS – 7.6%

20 LOWEST UNEMPLOYMENT RATES BY DEGREE:

- 1. ACTUARIAL SCIENCE & PHARMACOLOGY & EDUCATIONAL ADMINISTRATION AND SUPERVISION & SCHOOL STUDENT COUNSELLING & GEOLOGICAL AND GEOPHYSICAL ENGINEERING & ASTRONOMY AND ASTROPHYSICS, TIE – 0.0%

- 2. TEACHER EDUCATION: MULTIPLE LEVELS – 1.1%

- 3. AGRICULTURAL ECONOMICS – 1.3%

- 4. MEDICAL TECHNOLOGIES TECHNICIANS – 1.4%

- 5. ATMOSPHERIC SCIENCES AND METEOROLOGY – 1.6%

- 6. NAVAL ARCHITECTURE AND MARINE ENGINEERING – 1.7%

- 7. ENVIRONMENTAL ENGINEERING & NURSING & PUBLIC POLICY & NUCLEAR INDUSTRIAL RADIOLOGY AND BIOLOGICAL TECHNOLOGIES, TIE – 2.2%

- 8. PHYSICAL SCIENCES – 2.5%

- 9. TREATMENT THERAPY PROFESSIONS – 2.6%

- 10 PLANT SCIENCE AND AGRONOMY – 2.7%

- 11. MEDICAL ASSISTING SERVICES – 2.9%

- 12. SOCIAL SCIENCE OR HISTORY TEACHER EDUCATION & AGRICULTURE PRODUCTION AND MANAGEMENT & GENERAL AGRICULTURE, TIE – 3.0%

- 13. FORESTRY & INDUSTRIAL PRODUCTION TECHNOLOGIES, TIE – 3.1%

- 14. PHARMACY PHARMACEUTICAL SCIENCES AND ADMINISTRATION & GEOSCIENCES, TIE – 3.2%

- 15. COMMUNICATION DISORDERS SCIENCES AND SERVICES & OCEANOGRAPHY & MISCELLANEOUS HEALTH MEDICAL PROFESSIONS, TIE – 3.3%

- 16. MATHEMATICS TEACHER EDUCATION – 3.4%

- 17. MATHEMATICS AND COMPUTER SCIENCE – 3.5%

- 18. ELEMENTARY EDUCATION & AEROSPACE ENGINEERING & SPECIAL NEEDS EDUCATION, TIE – 3.6%

- 19. MISCELLANEOUS EDUCATION & MISCELLANEOUS AGRICULTURE, TIE – 3.7%

- 20. SECONDARY TEACHER EDUCATION & MECHANICAL ENGINEERING & CHEMICAL ENGINEERING, TIE – 3.8%

Source: http://www.workopolis.com/content/advice/article/1587-what-not-to-study-the-20-university-degrees-with-the-highest-unemployment-rates

The ideal situation is that you have already researched a career that actually requires a particular degree rather than obtaining a degree and then hoping that there is demand for it. Remember, the loss of time and salary will never return so be very careful when determining if this loss can be made up in the long-run, which is the goal we are trying to achieve here.

In a similar vein, the same degree but from different schools can have a huge impact on future salary prospects. For example, here is a useful study which shows the increase in income for different schools for MBA graduates.

A quick comparison calculation of how much a particular school costs and the potential increase in salary should help you narrow down which school yield the highest return on investment.

Loss of Salary

This includes not just the salary you will forsake during your studies (the opportunity cost they call it in business) but also the salary you will lose during your post graduation job search. In the relatively weak economic times we find ourselves in, the time elapsed from graduation to job is expanding. Another option to consider is part-time studying which can help to increase the number of working years/experience but prolongs the education and can make life in general more difficult to handle, which could affect grades.

Experience vs. Education

Potential students need to take into consideration the years of experience they will lose whilst they are in school (assuming they chose to go back full-time). It is important to thoroughly gauge the market you will be entering, some first hand research should be useful to determine if employers are slanting towards experience over further education. You don’t want to find yourself in the unenviable position of being overqualified for entry-level jobs and under experienced for more advanced positions.

Thus, you have another trade-off to consider, is it better financially to keep gaining experience in the current field you are in or change fields via a new/advanced degree with the risk of having a hard time breaking in due to lack of experience. Can you financially risk being out of the job market considering it is difficult for many to get in? (this is where a loving and financially stable partner can really help)

Final Thoughts

As you can see, there a variety of factors involved when trying to decide if going back to school is an alternative to improving your financial situation. The key is to take these factors into consideration rather than from feedback from friends or a ‘want’ to continue further education if you want to make a financially beneficial choice.

Here is a quick equation to summarize the ROI of going into further education, be it a masters or a PHD etc.

Cost of Degree (tuition fees, books etc) + The Opportunity Cost (the loss of salary during the education) = Total Cost

Anticipated Salary Increase (from research after obtaining further education) x Investment Period (10 years is a good prudent guide, but it depends on how many working years the potential student has left in the workforce) = Total Financial Gain

Therefore

Total Cost / Total Financial Gain x 100 = ROI

This article was researched and written by Hummad Waheed, a contributing author of promotionalcode.ca.

No Comments